CPA ADVANCED LEVEL

ADVANCED FINANCIAL MANAGEMENT

TUESDAY: 2 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question.

QUESTION ONE

(a) A project requires an initial investment of Sh.500,000. It is expected to generate cash inflows of Sh.200,000 per annum for the next 5 years.

Additional information:

1. The firm is indifferent between a certain amount of Sh.181,347 at the end of the first year and the expected amount of Sh.200,000.

2. The risk free rate of return is 5% per annum.

Required:

(i) The net present value (NPV) of the project incorporating certainty equivalent coefficient (CEC). (5 marks)

(ii) Advise the management on whether the project is worthwhile. (1 mark)

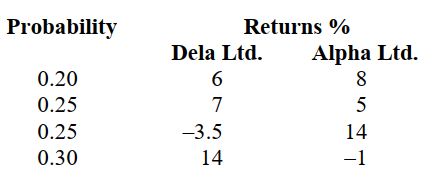

(b) An investor has decided to invest Sh.2,000,000 in the shares of two companies namely Dela Ltd. and Alpha Ltd.

The projections of returns from the shares of the two companies along with their associated probabilities are as follows:

Required:

(i) Determine the proportion of each of the above shares required to formulate a minimum risk portfolio. (8 marks)

(ii) The amount (in shillings) that should be invested in each share using the proportions determined in (b) (i) above. (2 marks)

(c) Describe four factors that could significantly impact on the price of cryptocurrencies. (4 marks)

QUESTION TWO

(a) Libe Ltd. debt-equity ratio, market value is 2:5. The corporate debt, which is assumed to yield a return similar to treasury bills have a rate of 10% before tax.

The beta value of the company’s equity is currently 1.1. The average returns on stock market equity are 15%. The company is now proposing to invest in a project which would involve diversification into a new industry.

The following information is available relating to this industry:

1. Average beta coefficient of equity capital is 1.60.

2. Average debt-equity ratio in the industry is 1:2 (market value).

3. The corporation rate of tax is 30%.

Required:

Determine the suitable cost of capital to apply to the project. (6 marks)

(b) Rona Hotel Ltd. is currently evaluating a proposal to take over Duet Restaurant Ltd. The Board of directors of Rona Ltd. is in the process of making a proposal for acquisition of Duet Restaurant Ltd. but first needs to place a value on the company.

Rona Ltd. has gathered the following financial data:

Rona Hotel Ltd.:

1. Weighted average cost of capital 12%

2. Price to earnings (P/E) ratio 12 times

3. Shareholders required rate of return 15%

Duet Restaurant Ltd.:

1. Current dividend payment per share (DPS) Sh.2.7

2. Past five years dividend payment:

Year 2017 2018 2019 2020 2021

Dividend per share (DPS) (Sh.) 1.5 1.7 1.8 2.1 2.3

3. The current Earnings Per Share (EPS) is Sh.3.7

4. The number of issued ordinary shares are 5 million shares.

Additional information:

1. It is estimated that the shareholders of Duet Restaurant Ltd. require a rate of return of 10% higher than that of Rona Ltd. owing to the higher level of risk associated with Duet Restaurant Ltd.’s operations.

2. Rona Restaurant Ltd. estimates that the free cash flows from Duet Restaurant Ltd. at the end of the first year will be Sh.2.5 million and these will grow at an annual rate of 5% for the first 4 years after which the growth rate will revert to the historical earnings/dividend growth rate in perpetuity.

3. Rona Ltd. expects to raise Sh.5 million at the end of year 2 selling off hotels of Duet Ltd. that are surplus of its needs.

Required:

Estimate values of Duet Restaurant Ltd. using the following valuation approaches:

(i) Price/earnings ratio model. (2 marks)

(ii) Dividend growth model. (3 marks)

(iii) Discounted free cash flow basis. (5 marks)

(c) Discuss Modigliani and Miller’s proposition in a real estate finance context clearly stating the assumptions of the theory. (4 marks)

QUESTION THREE

(a) Evaluate five benefits of a currency swap. (5 marks)

(b) A United States (US) company buys goods worth 1,440,000 Euros (€) from a German company payable in 30 days. The US company wants to hedge against the Euro (€) strengthening against the United States dollar ($).

The following exchange rates are provided:

Current spot rate: $/€ 0.9215 – 0.9221

Futures exchange rate: $/€ 0.9245.

The standard size of a 3 month € futures contract is €125,000. In 30 days time, the spot rate is 0.9345 – 0.9351 $/€ and closing futures price will be 0.9367 $/€.

Required:

Determine the net outcome of the futures currency hedge. (5 marks)

(c) Bezo Construction Company Ltd. made a Sh.20 million bond issue 5 years ago when interest rates were substantially high. The interest rates have now fallen and the firm wishes to retire this old debt and replace it with a new and cheaper one. Given below are details about the two bond issue:

Old Bond: The outstanding Sh.20 million bond has a nominal value of Sh.1,000 and a coupon rate of 20%. They were issued 5 years ago with a 25-year maturity. They were initially sold at 5% discount to attract investors and the firm incurred a floatation cost of Sh.450,000. The bond is callable at Sh.1,150 per unit.

New Bond: The new bond issue of Sh.20 million would have Sh.1,000 nominal value per unit and 18% coupon rate. They would have a 20-year maturity and will be sold at 10% discount to attract investors. Floatation cost on the new bond are estimated at Sh.550,000.

Assume two months overlapping period and corporation tax rate of 30%.

Required:

(i) Determine the incremental initial cash outlay required to issue the new bond. (4 marks)

(ii) Calculate the annual cash flow saving (if any), expected from the bond refinancing. (3 marks)

(iii) Determine the net present value (NPV) of the bond refinancing and hence advise the company accordingly. (3 marks)

QUESTION FOUR

(a) Assess four circumstances under which a company would consider reorganising its operations rather than liquidating. (4 marks)

(b) In relation to corporate restructuring and reorganisation, discuss the potential advantages for a company undertaking the divestment of one of its division means of:

(i) A sell off. (2 marks)

(ii) A demerger. (2 marks)

(iii) A divestment. (2 marks)

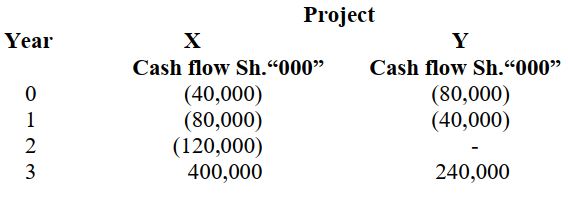

(c) Ngao Ltd. is considering investing in two capital investment projects; X and Y. The projects cash flows are provided as shown below:

The funds available for investment in both projects are restricted as follows:

Year Amount Sh.“000”

0 100,000

1 80,000

2 60,000

Additional information:

1. None of the projects will delay, that is, both investments will start in year 0.

2. The funds not utilised in one year shall not be available for investment in the subsequent years.

3. Both projects are divisible, that is, a project can be undertaken in part or in whole.

4. The cost of capital is 13%.

Required:

(i) Formulate a linear programming model to solve the problem. (4 marks)

(ii) Using the graphical approach, solve the linear programming model and hence determine the proportion of each project to be undertaken to maximise net present value (NPV). (6 marks)

QUESTION FIVE

(a) Summarise four objectives of the International Monetary Fund (IMF). (4 marks)

(b) Discuss four advantages of Foreign Direct Investment (FDI). (8 marks)

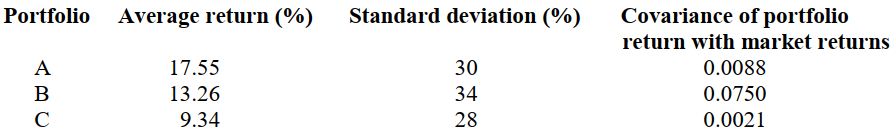

(c) The following information relates to the performance of three portfolios; A, B and C during the year ended 30 June 2022:

Additional information:

1. The market return and the risk-free rate averaged 14% and 7% respectively during the year ended 30 June 2022.

2. The standard deviation of the market is 10%.

Required:

Evaluate the performance of the three portfolios using:

(i) Sharpe’s performance measure. (4 marks)

(ii) Treynor’s performance measure. (4 marks)