CPA INTERMEDIATE LEVEL

CIFA INTERMEDIATE LEVEL

PILOT PAPER

PUBLIC FINANCE AND TAXATION

December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any

assumptions made must be clearly and concisely stated.

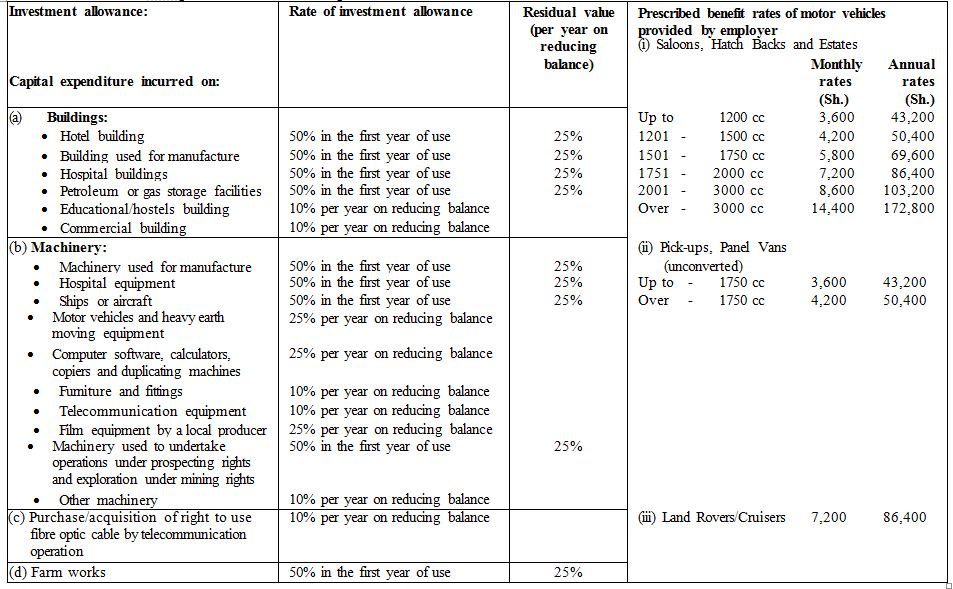

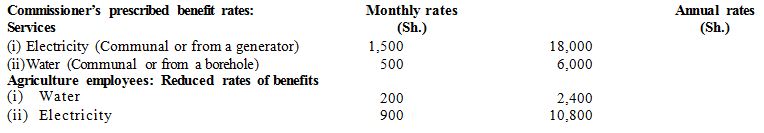

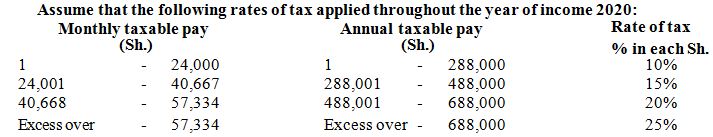

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE

(a) Discuss three roles played the National Assembly budget committee or equivalent institution in your country in relation to public finance management. (6 marks)

(b) The national and county governments engage in a number of projects. For the purpose of monitoring these projects the governments have developed an electronic project monitoring information system (e-ProMIS) to capture information on projects implemented the ministries, state corporations and counties.

Required:

Discuss four specific objectives that the National and County governments might realise from the e-ProMIS

(8 marks)

(c) Discuss three reasons why Public Sector Finance is important in your country (3 marks)

(d) Discuss three roles of the National Treasury in public procurement and assets disposal. (3 marks)

(Total: 20 marks)

QUESTION TWO

(a) Highlight the steps followed your county government in developing its annual budget. (9 marks)

(b) The County Treasury is required to submit to the county assembly a statement setting out the debt management strategy of the county government over the medium term with regard to its actual liability and potential liability in respect of loans and its plans for dealing with those liabilities.

Required:

Identify the information to be included in the statement of debt management strategy (5 marks)

(c) Discuss three roles of taxation in achieving budgetary objectives (3 marks)

(d) During a devolution seminar in your country, one of the key speakers noted that country governments should be allocated national government share of revenue based on the ability of a county to enhance its revenue raising measures.

Required:

Identify three sources of revenue to the county governments. (3 marks)

(Total: 20 marks)

QUESTION THREE

Mr. Japtheth Murunga is employed as a finance manager Top Notch Ltd. He reported the following details on his income and that of his wife for the year ended 31 December 2020:

1. He was entitled to a basic salary of Sh.2,500,000 per annum (PAYE Sh.250,000 per annum).

2. The employer provided him with a motor vehicle (2600 cc) which was leased from Unique Car Hire Services at Sh.32,000 per month. The cost of the vehicle was Sh.2800,000 in 2018

3. His annual mortgage repayment of Sh.576,000 (including interest of Sh.120,000) was paid the employer. The loan was obtained from Absa Bank in 2019 for the purpose of constructing own residential house.

4. He was entitled to a bonus of Sh.120,000 per annum, The bonus for 2020 was however not paid until February 2021.

5. The• following deductions were made from his salary during the year:

Sh.

Life insurance premiums 96,000

Subscription to Railway Golf Club 56,000

Subscription to accountants professional body 90,000

Contributions to registered pension scheme 300,000

6. During the year he received a dividend from Top Notch Ltd. of Sh.120, 000 (gross) since he holds 2% of the company’s share capital. The employer paid the Withholding tax on his behalf.

7. His wife Truphena Murunga works for a Taxation consultancy firm where she received a basic salary of Sh.80,000 per month. She is housed the firm together with her family in a house where she contributes 3% of her basic pay as rent. She received the following additional benefits for the year ended 31 December 2020:

• Subsistence allowance of Sh.6,000 per day. In total she worked out of the office station for 21 days in the year.

• Medical allowance of Sh.10, 000 per month. The firm has a medical scheme for all senior managers.

• She enrolled for a seminar on women empowerment in Kenya at Sh.120,000. 30% of this cost was met the employer.

• She received 10,000 shares from the company at a price of Sh.50 per share. The par value share is Sh.72 while the market price at the time was Sh.79 per share.

Her other income comprised:

Interest income: Sh.

Housing development bonds 200,000

Treasury bonds 120,000

Century Ltd. 85,000 (net)

Dividend income: Mapato Sacco Ltd. 95,000 (net)

Uwezo Co-operative Society 150,000 (gross)

Rental income from residential property 290,000 per month

Reported farming income was Sh.48,000 after deducting own consumption of Sh.20,000 which was equivalent to 18% of total farm produce.

8. Mr. Japtheth and his wife have agreed that each files his or her returns to the revenue authority.

Required:

(a) Taxable income of Mr. Japtheth and his wife. (16 marks)

(b) Tax due on the income(s) computed in (a) above. (4 marks)

(Total: 20 marks)

QUESTION FOUR

(a) Ernest a citizen of USA has been assigned to work for his company’s branch located in Kenya for the next ten years. He has approached you to assist him in understanding the Kenyan tax system especially on the basis of taxing an income in Kenya.

Required:

Explain to Ernest the Cardinal rules of taxing an income in Kenya. (5 marks)

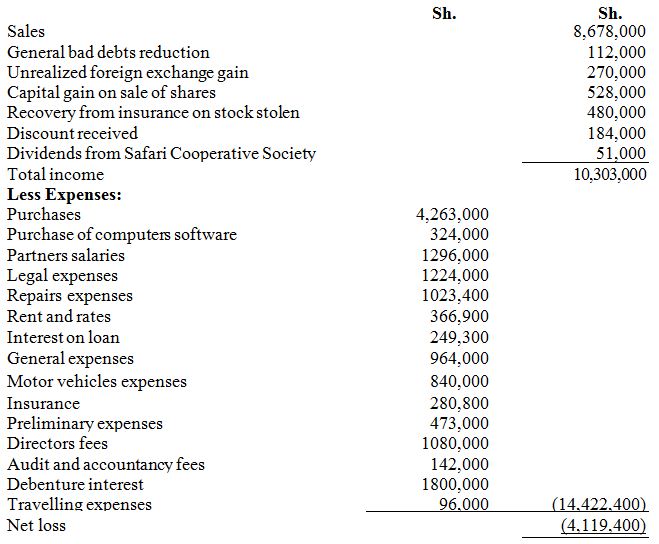

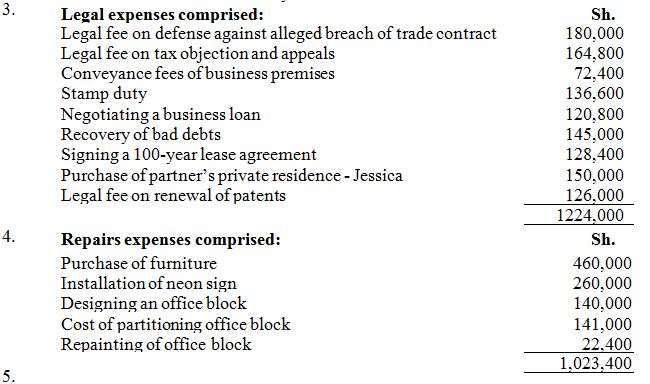

(b) Jessica and Mbatha established a partnership business sharing profits and losses in the ratio of 3:2 respectively. The following is the income statement of the partnership for the year ended 31 December 2020:

Additional information:

1. Purchases and sales were inclusive of value added tax at a rate of 16%.

2. Closing stock was valued at Sh. 1, 840,000 while opening stock was at 10% of sales net of value added tax. Both stocks were undervalued 10%.

General expenses included, impairment of patent rights Sh.144, 000, provision for general bad debts Sh.148, 000 and drawings of goods partners Sh.568, 000.

6. Interest on loan includes interest on partners’ capital of Sh.120, 000 which was shared according to profit and loss sharing ratio.

Required:

Compute the total taxable income for each partner for the year ended 31 December 2020. (15 marks)

(Total: 20 marks)

QUESTION FIVE

(a) Johari Ltd. a manufacturer of leather products commenced operation on 1 January 2020. The following information relates to the assets that the company purchased or constructed before commencement of operations.

Asset Cost (Sh.)

Factory building (including godown Sh.700,000) 3,800,000

Parking bay 480,000

Drainage systems 240,000

Delivery van 420,000

Processing machine 1,680,000

Security wall 720,000

Office block (including staff canteen Sh.380,000) 980,000

Additional information:

1. Processing machine was imported and includes customs duty and VAT of Sh.120,000 and Sh.100,000 respectively which was waived the government.

2. On 1 September 2020, the company sunk a borehole at a cost of Sh.1,600,000 and installed a water pump for sh.200,000.

3. Spots pavilion was constructed at a cost of Sh.1,200,000 and put to use from 1 May 2020.

Required:

Compute the investment allowances due to Johari Ltd for the year ended 31 December 2020. (5 marks)

(b) Bitech Ltd. is registered for VAT. In May 2021, the company imported goods costing sh. 2,600,000 excluding freight charges of Sh.180,000.

The company then incurred Sh.400,000 to transport the goods from the port to its warehouse.

The conversion costs were 25% of the relevant costs incurred up to the point of processing.

The goods were subsequently sold at a profit margin of 33 1/3%.

Required:

The VAT payable on the above transaction. Use a VAT rate of 16% and customs duty rate of 25%. (5 marks)

(c) Analyse three circumstances where the revenue authority might cancel a taxpayer’s personal identification number. (3 marks)

(d) Write brief notes on the following terms as used in taxation:

(i) Tax agents. (2 marks)

(ii) Excisable Goods Management System. (2 marks)

(iii) Warehousing of goods. (2 marks)

(iv) Railway development levy. (1 mark)

(Total: 20 marks)