CPA ADVANCED LEVEL

PILOT PAPER

ADVANCED FINANCIAL REPORTING AND ANALYSIS

December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

Help Limited acquired Save Limited on 1 July 2019. Save Ltd. is in a foreign country whose currency is the Zora (Zr).

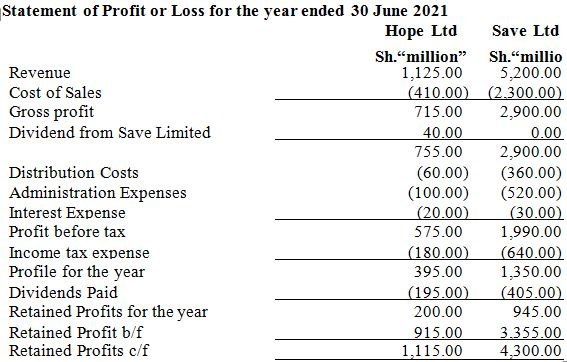

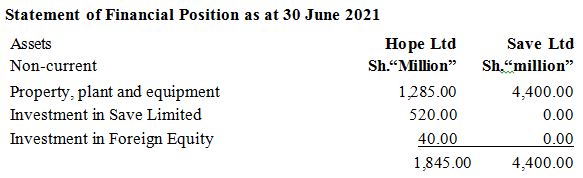

The following financial statements relate to the two companies for the year ended 30 June 2021.

Statement of Profit or Loss for the year ended 30 June 2021

Additional information:

1. Help Limited acquired 80% of Save Limited for Sh.520 million on 1 July 2019 when the retained reserves of Save Limited were Zr 2,500 million. The property, plant and equipment had a fair value of Zr 300 million in excess of the book value, attributable mainly to land. The noncontrolling interest had a fair value of Zr 1,000 million on 1st July 2019.

2. In the year ended 30 June 2020, Save Limited reported Zr 1,200 million as profit after tax and paid dividends of Zr 345 million.

3. During the year ended 30 June 2021, Help Limited sold goods worth Sh.100 million to Save Limited, reporting a gross profit margin of 30%. 50% of the goods remain unsold the end of the year.

4. Included in the trade receivables of Help Limited is Sh.20 million due from Save Limited.

5. The investment in foreign equity represents 15% investment in Roma Limited, a listed company in the same country as Save Limited. The investment was acquired on 1 July 2020, at a cost of Zr 352 million. The investment is being accounted for at fair value through other comprehensive incomes, though Help Limited is yet to account for the changes in fair value, which is valued at Zr 405 million on 30 June 2021. Roma Limited did not pay any dividend during the year.

6. An impairment test conducted at 30 June 2021 revealed impairment losses of 25% relating to Save Limited’s goodwill. No impairment losses had previously been recognized. It is the group’s policy to translate impairment losses at the closing rate.

7. The following exchange rates are relevant:

Sh.1 to Zr

1 July 2019 9.4

30 June 2020 8.8

Average 19/20 9.1

30 June 2021 8.1

Average 20/21 8.4

8. The company applies where relevant deferred tax on exchange differences arising from translating the subsidiary, the foreign equity, but not on translating goodwill in the subsidiary. The effective tax rate is 30%.

Required:

(a) The consolidated statement of profit or loss and comprehensive income for the year ended 30 June 2021, showing the profit attributable to parent and non-controlling interest at the two levels. (8 marks)

(b) The consolidated statement of financial position as at 30 June 2021. (8 marks)

(c) Four disclosures that Help Limited will make for both Save Limited and Roma Limited as per the requirements of

IFRS 12’ Disclosures of interest in other entities’. (4 marks)

(NB): For the translated figures of Save Limited, round off to the nearest whole number.

(Total: 20 marks)

QUESTION TWO

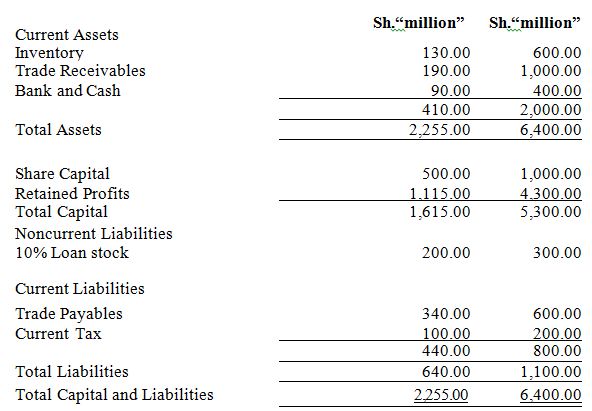

(a) You are given the following list of balances for Star Bank Limited as at 31 December 2020

Additional Information:

1. Accrue interest income and expense at Sh.240 million and Sh.100 million respectively.

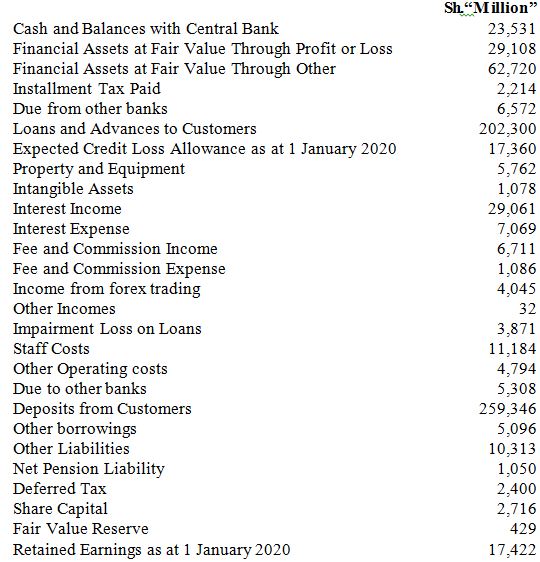

2. For the purpose of estimating the expected credit loss on loans and advances at the end of the year, the following aggregated data is available:

Loans Exposure at Probability of Loss Given

Default (EAD) Default (PD) Default (LGD)

Sh.“million”

Category 1 22,300 5% 100%

Category 2 54,800 10% 50%

Category 3 65,700 50% 30%

Category 4 59,500 100% 10%

202,300

3. Depreciation and amortization expense for the period amounted to 1,200 million (200 million amortization).

4. The following are the estimated fair values for the financial assets as at 31 December 2020. Sh.“million”

FA at Fair Value Through Profit or Loss 29,708.00

FA at Fair Value Through Other Comprehensive Incomes 63,230.00

5. The bank operates a defined benefit pension plan. Except for the contribution made, which is included in the staff cost, the following details have not been accounted for in the year:

Sh.“million”

Plan Obligation as at 1 January 2020 4,250

Fair Value of Plan Assets as at 1 January 2020 3,200

Current Service Cost 460

Benefits Paid 40

Interest rate cost estimated at 8% ?

Expected return on Plan Assets at 6% ?

Contributions made 25

Plan Obligation as at 31 December 2020 5,192

Fair Value of Plan Assets at 31 December 2020 3,419

6. The net taxable temporary differences as at the end of the period are estimated at Sh.9,300 million. This excludes any temporary differences from note 4 and 5. The tax rate is 30%. Meanwhile the current tax for the year is estimated at Sh.2,800 million.

Required:

(a) Prepare the following financial statements:

(i) The statement of Profit or Loss for the year ended 31 December 2020. (10 marks)

(ii) The statement of Financial Position as at 31 December 2020. (7 marks)

(b) A client of the Star bank Limited in (a) above, an airline, has entered into a swap contract with the bank to hedge adverse changes in fuel prices.

Required:

Explain whether the swap contract should be accounted for as an embedded derivative of the fuel contract or as a separate contract under IFRS 9. (3 marks)

(Total. 20 marks)

QUESTION THREE

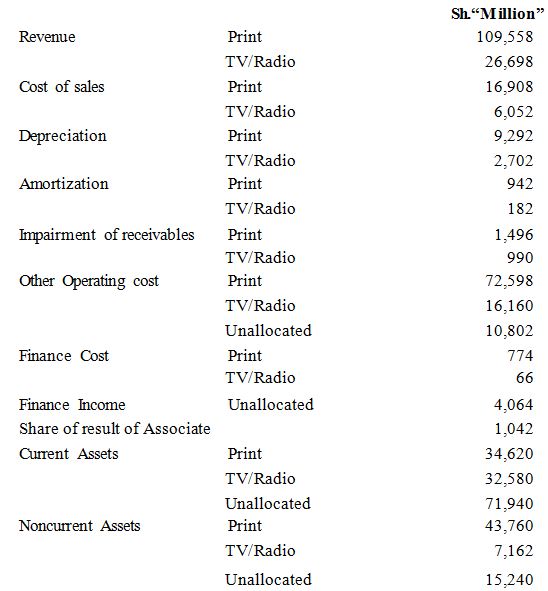

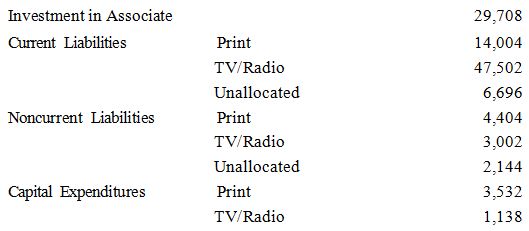

(a) Mtangazaji Limited operates in Kenya and in other East African countries. The company has two operating segments; Print and TV/Radio.

The following details apply for the year ended 30 June 2021:

Required:

(i) As far as the information permits, prepare the segmental report showing the results of each segment and for the combined entity. (10 marks)

(ii) Highlight areas that Mtangazaji Limited needs to improve in segmental reporting to comply with IFRS 8 ‘segment report’. (5 marks)

(c) Mtangazaji Limited in (a) above is also evaluating the following data for the purpose of making relevant disclosures in accordance with IAS 24 ‘Related Parties’:

Party Status Transaction in the year Balance due to/from

Wema Limited Subsidiary -90% Sale of goods Sh.20 million Sh. 5 million

receivables

Povu Limited Subsidiary -60% Purchase of goods Sh.10 million Sh.3 million Payables

Zoal Limited Associate – 30% Sale of goods Sh.10 million Sh. 2 million

Receivables

Mr James Baraka Nonexecutive Director – 5% Directors Emoluments Sh.2 million No Balance

Shareholder

Jopo Limited Fellow Joint Venturer in No Transaction No Balance

Bitha (50%)

Bitha Limited Joint venture (50%) No Transaction No Balance

Baza Bank Limited Major Lender Loan at sh.25 million Sh. 20 million

Required:

Highlight the related parties to be disclosed, the nature of the relationship to be disclosed and the intercompany transactions and balances. (5 marks)

(Total: 20 marks)

QUESTION FOUR

(a) In relation to IPSAS 21 and IPSAS 26, distinguish between a cash generating asset and a non cash generating asset. (4 marks)

(b) Using suitable examples, explain four external factors that indicate an asset is impaired under both IPSAS 21 and IPSAS 26. (8 marks)

(c) In 2019, the Nairobi County’s Department of Education constructed a new school, which enrolled students beginning July 2019. The furniture and other equipment cost sh.15,000,000. It was estimated that the furniture and equipment would be used for 10 years. Due to Covid-19 pandemic, enrolment declined from 2,000 to 400 students, and parents moved their children to other spacious schools to observe social distancing protocols. The Department decided to close the two top floors of the three-storey school building and there is no expectation that enrolments will increase in the future such that the upper storeys would be reopened. The current replacement cost of the one-storey furniture and equipment is estimated at Sh.9,000,000.

Required:

Calculate the impairment loss and explain the accounting treatment the department 30 June 2021. (6 marks)

(d) The ministry is now considering leasing the school in (c) above to a private individual to operate the school with effect from July 2022.

Explain whether this redesignation will lead to a reversal of the impairment loss the year ended 30 June 2022.

(2 marks)

(Total. 20 marks)

QUESTION FIVE

(a) The revised conceptual framework came into effect in 2018 and changes the definition of financial statements elements of assets and liabilities, their recognition and derecognition.

Required:

Highlight the new definitions of assets and liabilities, their recognition and derecognition. (6 marks)

(b) The Global Reporting Initiative (GRI) is a non-profit making organization that provides guidelines on how companies can report the impact of their activities on people and the environment (Sustainability Reporting). The latest 2020 Sustainability reporting guidelines aim to improve three pillars of sustainability reporting; economic, social and environmental.

Required:

Provide three disclosures required under each of the three pillars. (6 marks)

(c) The International Accounting Standards Board has issued the Practice Statement Exposure Draft ED/2021/6, which aims to improve the current management commentary.

Required:

(i) Briefly explain what a management commentary is. (2 marks)

(ii) Summarise the six content areas that the exposure draft proposes for preparation of a management

commentary. (6 marks)

(Total. 20 marks)