CPA ADVANCED LEVEL

ADVANCED FINANCIAL REPORTING AND ANALYSIS (AFRA)

ADVANCED FINANCIAL REPORTING & ANALYSIS THEORY

IAS 24 Related parties

Definition of a related party

A related party is defined as ‘a person or entity that is related to the entity that is preparing its financial statements’

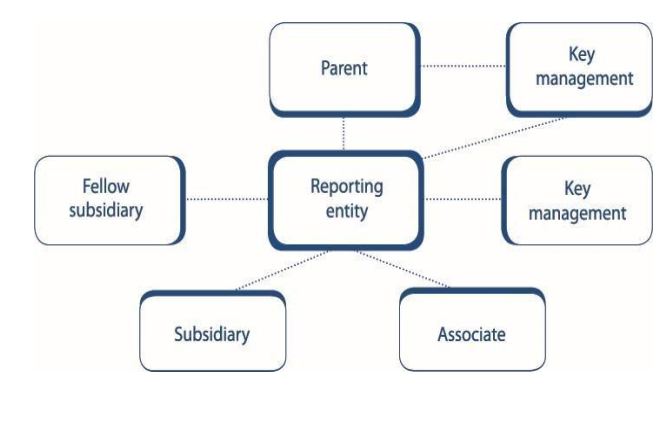

IAS 24 gives the following rules which should be used to determine the existence of related party relationships:

a. ‘A person or a close member of that person’s family is related to a reporting entity if that person:

i. has control or joint control of the reporting entity

ii. has significant influence over the reporting entity

iii. is a member of the key management personnel of the reporting entity or of a parent of the reporting entity

b. An entity is related to a reporting entity if any of the following conditions apply:

i. The entity and the reporting entity are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others)

ii. One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member)

iii. Both entities are joint ventures of the same third party

iv. One entity is a joint venture of a third entity and the other entity is an associate of the third entity

v. The entity is a post-employment benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity

vi. The entity is controlled or jointly controlled a person identified in (a)

vii. A person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity)

viii. The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity.’

Group accounting is covered in a later chapter. You may therefore find the following definitions useful:

• A subsidiary is an entity over which an investor has control.

• A joint venture is an entity over which an investor has joint control.

• An associate is an entity over which an investor has significant influence.

Note that, in the definition of a related party, ‘an associate includes subsidiaries of the associate and a joint venture includes subsidiaries of the joint venture’

IAS 24 notes that the following should not be considered related parties:

• two entities just because they have a director or other member of key management personnel in common

• two joint ventures just because they share joint control of a joint venture

• a customer or supplier with whom an entity transacts a significant volume of business. Substance over form should be applied when deciding if two parties are related.

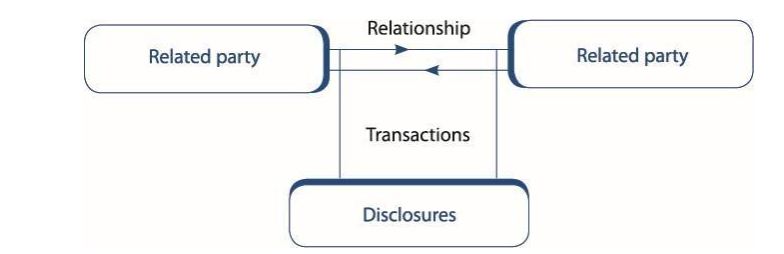

Related parties’ summary

Disclosure of related parties

Parent and subsidiary relationships

IAS 24 requires that relationships between parents and subsidiaries should always be disclosed. The name of the parent and, if different, the ultimate controlling party should be given.

Key management personnel

Total compensation granted to key management personnel should be disclosed and broken down into the following categories:

• short-term benefits

• pension benefits

• termination benefits

• share-based payment schemes.

Disclosure of transactions and balances

If there have been transactions between related parties, and/or if there are balances outstanding between the parties, the following should be disclosed:

- the nature of the related party relationship

- the amounts of the transactions

- the amounts and details of any outstanding balances

- allowances for receivables in respect of the outstanding balances

- the irrecoverable debt expense in respect of outstanding balances.

Government-related entities

A reporting entity is exempt from the above disclosures in respect of transactions and balances that they have with a government that has control, joint control or significant influence over the reporting entity.

If this exemption is applied, IAS 24 requires that the following disclosures are made instead:

- details of the government and a description of its relationship with the reporting entity

- details of individually significant transactions

- an indication of the extent of other transactions that are significant in aggregate.

Small and medium entities Definition

A small or medium entity may be defined or characterized as follows:

- they are usually owner-managed a relatively small number of individuals such as a family group, rather than having an extensive ownership base

- they are usually smaller entities in financial terms such as revenues generated and assets and liabilities under the control of the entity they usually have a relatively small number of employees

- they usually undertake less complex or difficult transactions which are normally the focus of a financial reporting standard.

The problem of differential reporting

There are problems associated with having a set of reporting standards for small and medium entities:

- It can be difficult to define a small or medium entity.

- If a company ceases to qualify as a small or medium entity, then there will be a cost and time burden in order to comply with full IFRS and IAS Standards.

- There may be comparability problems if one company applies full IFRS and IAS Standards whilst another applies the SMEs Standard.

What is the effect of introducing the SMEs Standard?

The SMEs Standard will be updated approximately every three years. In contrast, companies that use full IFRS and IAS Standards have to incur the time cost of ensuring compliance with regular updates.

Key omissions from the SMEs Standard

The subject matter of several reporting standards has been omitted from the SMEs Standard, as follows:

- Earnings per share (IAS 33)

- Interim reporting (IAS 34)

- Segmental reporting (IFRS 8)

- Assets held for sale (IFRS 5).

Omission of subject matter from the SMEs Standard is usually because the cost of preparing and reporting information exceeds the expected benefits which users would expect to derive from that information.

Accounting choices disallowed under the SMEs Standard

There are a number of accounting policy choices allowed under full IFRS and IAS Standards that are not available to companies that apply the SMEs Standard. Under the SMEs Standard:

- Goodwill is always recognized as the difference between the cost of the business combination and the fair value of the net assets acquired. In other words, the fair value method for measuring the non- controlling interest is not available.

- Intangible assets must be accounted for at cost less accumulated amortization and impairment. The revaluation model is not permitted for intangible assets.

- After initial recognition, investment property is remeasured to fair value at the year end with gains or losses recorded in profit or loss. The cost model can only be used if fair value cannot be measured reliably or without undue cost or effort.

Key simplifications in the SMEs Standard

The subject matter of other reporting standards has been simplified for inclusion within the SMEs Standard. Key simplifications to be aware of are as follows:

- Borrowing costs are always expensed to profit or loss.

- Whilst associates and jointly controlled entities can be accounted for using the equity method in the consolidated financial statements, they can also be held at cost (if there is no published price quotation) or fair value. Therefore, simpler alternatives to the equity method are available.

- Depreciation and amortization estimates are not reviewed annually. Changes to these estimates are only required if there is an indication that the pattern of an asset’s use has changed.

- Expenditure on research and development is always expensed to profit or loss.

- If an entity is unable to make a reliable estimate of the useful life of an intangible asset, then the useful life is assumed to be ten years.

- Goodwill is amortized over its useful life. If the useful life cannot be reliably established, then management should use a best estimate that does not exceed ten years.

- On the disposal of an overseas subsidiary, cumulative exchange differences that have been recognized in other comprehensive income are not recycled to profit or loss.

- There are numerous simplifications with regards to financial instruments. These include:

– Measuring most debt instruments at amortized cost.

– Recognizing most investments in shares at fair value with changes in fair value recognized in profit or loss. If fair value cannot be measured reliably then the shares are held at cost less impairment

Advantages and disadvantages of the SMEs Standard

Advantages

- There will be time and cost savings due to simplifications and omissions, particularly with regards to disclosure.

- The SMEs Standard is worded in an accessible way.

- All standards are located within one document so it is therefore easier and quicker to find the information required.

Disadvantages

- There are issues of comparability when comparing one company that uses full IFRS and IAS Standards and another which uses the SMEs Standard.

- The SMEs Standard is arguably still too complex for many small companies. In particular, the requirements with regards to leases and deferred tax could be simplified.

Developments in sustainability reporting

Background

Sustainable development consists of balancing local and global efforts to meet basic human needs without destroying

or degrading the natural environment.

Sustainable Development Goals (SDGs) are a range of 17 goals agreed UN member states that include no poverty, zero hunger, decent work, reduced inequalities, and responsible production and consumption. Some of these will only be achieved through the cooperation of industry.

There are lots of reasons why companies should set their own sustainable development goals:

- It is ethical

- Government funding will increasingly focus on sustainable businesses

- There will be a reduction in reputational and regulatory risk

- Sustainable products and services are a growth area

- Short-term, profit-based models are now less relevant for many investors.

Investors are increasingly interested in companies that make a credible contribution to some of the SDGs. Investors will see opportunities in companies that address the risks to people and the environment and those companies that develop new products and services which will have positive impacts on the achievement of SDGs. Conversely, when making investment decisions, some investors employ screening tactics, eliminating companies that exhibit specific characteristics, such as low pay or high levels of gender inequality.

Reporting standards and initiatives

It is vital for companies to carefully consider how to communicate their commitment to, and progress towards, SDGs. There are many reporting initiatives that can be used:

– The United Nations Global Compact (UNGC) is an initiative to support UN goals. It encourages entities to produce an annual Communication in Progress (COP) report, in which they describe the practical actions taken to implement UN principles in respect of human rights, labor, the environment, and anti-corruption.

– The Global Reporting Initiative (GRI) publishes the most widely used standards on sustainability reporting and disclosure. Using the GRI standards should mean that entities produce balanced reports that represent their positive and negative economic, environmental and social impacts. GRI principles encourage stakeholder engagement in order to ensure that their information needs are met.

– The International Integrated Reporting Council has published the International Integrated Reporting Framework. This is discussed in more detail in the next section of this chapter.

Legislation

Many countries are introducing legislation on sustainability reporting:

- The Singapore Stock Exchange has made sustainability reporting mandatory for listed companies, on a ‘comply or explain’ basis.

- The European Union requires certain large companies to disclose non- financial information on employee diversity.

Although these are positive moves, the lack of an agreed set of standards causes significant diversity in how entities report sustainability issues.

Integrated reporting

What is the International Integrated Reporting Council?

The International Integrated Reporting Council (IIRC) was created to respond to the need for a concise, clear, comprehensive and comparable integrated reporting framework.

The IIRC define an integrated report (IR) as ‘a concise communication about how an organization’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value in the short, medium and long term.’

The IIRC believe that integrated reporting will contribute towards a more stable economy and a more sustainable world.

What is the role of the IIRC?

The role of the IIRC is to:

• develop an overarching integrated reporting framework setting out the scope of integrated reporting and its key components

• identify priority areas where additional work is needed and provide a plan for development

• consider whether standards in this area should be voluntary or mandatory and facilitate collaboration between standard-setters and convergence in the standards

needed to underpin integrated reporting; and

• promote the adoption of integrated reporting relevant regulators and report preparers.

Objective of the Framework

The IR Framework establishes ‘guiding principles’ and ‘content elements’ that govern the overall content of an integrated report. This will help organizations to report their value creation in ways that are understandable and useful to the users.

The IR Framework is aimed at the private sector, although could be adapted for use charities and the public sector.

The key users of an integrated report are deemed to be the providers of financial capital. However, the report will also benefit employees, suppliers, customers, local communities and policy makers.

Fundamental concepts in the IR framework

An integrated report explains how an entity creates value over the short-, medium- and longterm. To this extent, a number of fundamental concepts underpin the IR framework. These are:

• The capitals

• The organization’s business model

• The creation of value over time.

The capitals are stocks of value that are inputs to an organization’s business model. The capitals identified the IR Framework are financial, manufactured, intellectual, human, social and relationship, and natural.

The capitals will increase, decrease or be transformed through an organization’s business activities. For example:

• The use of natural resources will decrease natural capital, making a profit will increase financial capital.

• Employment could increase human capital through training, or reduce human capital through unsafe or exploitative working practices.

Central to integrated reporting is the overall impact that a business has on the full range of capitals through its business model.

The business model is a business’ chosen system of inputs, business activities, outputs and outcomes that aims to create value over the short, medium and long term.

• An integrated report must identify key inputs, such as employees, or natural resources. It is important to explain how secure the availability, quality and affordability of components of natural capital are.

• At the center of the business model is the conversion of inputs into outputs through business activities, such as planning, design, manufacturing and the provision of services.

• An integrated report must identify an organization’s key outputs, such as products and services. There may be other outputs, such as chemical by- products or waste. These need to be discussed within the business model disclosure if they are deemed to be material.

• Outcomes are defined as the consequences (positive and negative) for the capitals as a result of an organization’s business activities and outputs. Outcomes can be internal (such as profits or employee morale) or external (impacts on the local environment).

Value is created over time and for a range of stakeholders. IR is based on the belief that the increasing financial capital (e.g. profit) at the expense of human capital (e.g. staff exploitation) is unlikely to maximize value in the longer term. IR thus helps users to establish whether short-term value creation can be sustained into the medium- and long-term.

Guiding principles

The following Guiding Principles underpin the preparation of an integrated report.

• Strategic focus and future orientation – An integrated report should provide insight into the organization’s strategy; how it enables the organization to create value in the short, medium and long term; and its effects on the capitals.

• Connectivity of information – An integrated report should show a holistic picture of the factors that affect the organization’s ability to create value.

• Stakeholder relationships – An integrated report should provide insight into the nature and quality of the organization’s relationships with its stakeholders.

• Materiality – An integrated report should disclose information on matters that significantly affect the organization’s ability to create value.

• Conciseness – An integrated report should be concise.

• Reliability and completeness – An integrated report should be balanced and free from material error.

• Consistency and comparability – The information in an integrated report should be comparable over time, and comparable with other entities.

The content of an integrated report

An integrated report should include all of the following content elements:

• Organizational overview and external environment – ‘What does the organization do and what are the circumstances under which it operates?’

• Governance – ‘How does the organization’s governance structure support its ability to create value in the short, medium and long term?’

• Opportunities and risks – ‘What are the specific opportunities and risks that affect the organization’s ability to create value over the short, medium and long term, and how is the organization dealing with them?’

• Strategy and resource allocation – ‘Where does the organization want to go and how does it intend to get there?’

• Outcomes are defined as the consequences (positive and negative) for the capitals as a result of an organization’s business activities and outputs. Outcomes can be internal (such as profits or employee morale) or external (impacts on the local environment).

Value is created over time and for a range of stakeholders. IR is based on the belief that the increasing financial capital (e.g. profit) at the expense of human capital (e.g. staff exploitation) is unlikely to maximize value in the longer term. IR thus helps users to establish whether short-term value creation can be sustained into the medium- and long-term.

Guiding principles

The following Guiding Principles underpin the preparation of an integrated report.

• Strategic focus and future orientation – An integrated report should provide insight into the organization’s strategy; how it enables the organization to create value in the short, medium and long term; and its effects on the capitals.

• Connectivity of information – An integrated report should show a holistic picture of the factors that affect the organization’s ability to create value.

• Stakeholder relationships – An integrated report should provide insight into the nature and quality of the organization’s relationships with its stakeholders.

• Materiality – An integrated report should disclose information on matters that significantly affect the organization’s ability to create value.

• Conciseness – An integrated report should be concise.

• Reliability and completeness – An integrated report should be balanced and free from material error.

• Consistency and comparability – The information in an integrated report should be comparable over time, and comparable with other entities.

The content of an integrated report

An integrated report should include all of the following content elements:

• Organizational overview and external environment – ‘What does the organization do and what are the circumstances under which it operates?’

-

- Governance – ‘How does the organization’s governance structure support its ability to create value in the short, medium and long term?’

- Opportunities and risks – ‘What are the specific opportunities and risks that affect the organization’s ability to create value over the short, medium and long term, and how is the organization dealing with them?’

- Strategy and resource allocation – ‘Where does the organization want to go and how does it intend to get there?’

- Business model – ‘What is the organization’s business model and to what extent is it resilient?’

- Performance – ‘To what extent has the organization achieved its strategic objectives and what are its outcomes in terms of effects on the capitals?’

- Future outlook – ‘What challenges and uncertainties is the organization likely to encounter in pursuing its strategy, and what are the potential implications for its business model and future performance?’

- Basis of presentation – ‘How does the organization determine what matters to include in the integrated report and how are such matters quantified or evaluated?’

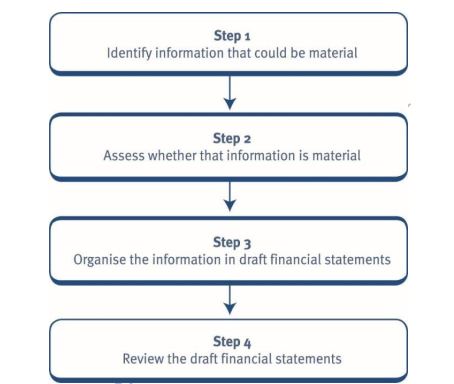

Materiality

Background

Materiality as a concept is used widely in financial reporting. However, the Board accepts that further guidance is

needed on how to apply it to the preparation and interpretation of financial statements.

The Practice Statement

The Board have issued a Practice Statement called Making Materiality Judgements. This provides non-mandatory guidance that may help preparers of financial statements when applying IFRS Standards.

The key contents of the Practice Statement are summarized below.

Definitions and objectives

Information is material if omitting, misstating or obscuring it would influence the economic decisions of financial statement users.

The objective of financial statements is to provide useful information about the reporting entity to existing and potential investors, lenders and other creditors to help them make decisions about providing resources to that entity. This requires that the preparers of the financial information make materiality judgements.

When assessing whether information is material, an entity should consider:

- Quantitative factors – measures of revenue, profit, assets, and cash flows

- Qualitative factors – related party transactions, unusual transactions, geography, and wider economic uncertainty.

Materiality judgements are relevant to recognition, measurement, presentation and disclosure decisions.

Recognition and measurement

An entity only needs to apply the recognition and measurement criteria in an IFRS Standard when the effects are material.

Presentation and disclosure

An entity only needs to apply the disclosure requirements in an IFRS Standard if the resulting information is material.

The entity may need to provide additional information, not required an IFRS Standard, if necessary to help financial statement users understand the financial impact of its transactions during the period.

When organizing information, entities should:

• Emphasize material matters

• Ensure material information is not obscured immaterial information

• Ensure information is entity-specific

• Aim for simplicity and conciseness without omitting material detail

Users

- Ensure formats are appropriate and understandable (e.g. tables, lists, narrative)

- Provide comparable information

- Avoid duplication.

Materiality judgements must be based on the needs of the primary users of financial statements. The primary users are current and potential investors, lenders and creditors.

Financial statements cannot meet all of the information needs of the primary users. However, preparers of financial statements should aim to meet common information needs for each group of primary users (e.g. investors, lenders, other creditors).

Process The Board recommends a systematic process when making materiality judgements:

Management commentary

Purpose of Management Commentary

The IFRS Practice Statement Management Commentary provides a framework for the preparation and presentation of management commentary on a set of financial statements.

Management commentary provides users with more context through which to interpret the financial position, financial performance and cash flows of an entity.

It is not mandatory for entities to produce a management commentary.

Framework for presentation of management commentary The purpose of a management commentary is:

- to provide management’s assessment of the entity’s performance, position and progress

- to supplement information presented in the financial statements, and

- to explain the factors that might impact performance and position in the future.

This means that the management commentary should include information which is forward-looking.

Information included in management commentary should possess the qualitative characteristics of useful information (as outlined in the Conceptual Framework). In other words, the information should be relevant, faithfully represented, comparable, timely, verifiable and understandable.

Elements of management commentary

Management commentary should include information that is essential to an understanding of:

- the nature of the business

- management’s objectives and strategies

- the entity’s resources, risks and relationships

- the key performance measures that management use to evaluate the entity’s performance.

Historical financial statements are often criticized for lacking adequate discussion about risk. The inclusion of management commentary would therefore be extremely beneficial to the primary users of the financial statements – current and potential investors as well as lenders and other creditors. This should help them to make more informed economic decisions.

Accounting in the current business environment Cryptocurrency

Cryptocurrencies are virtual currencies that provide the holder with various rights. They are not issued a central authority and so exist outside of governmental control. Cryptocurrencies, such as the Bitcoin, can be used to purchase some goods and services although they are not yet widely accepted. The market value is extremely volatile and some investors make high returns through short-term trade.

The accounting treatment of cryptocurrency is not clear cut.

Cryptocurrencies do not constitute ‘cash’ because they cannot be readily exchanged for goods and services. Moreover, they do not qualify as a ‘cash equivalent’ (in accordance with IAS 7 Statement of Cash Flows) because they are subject to a significant risk of a change in value.

An investment in cryptocurrency does not represent an investment in the equity of another entity or a contractual right to receive cash, and so does not meet the definition of a financial asset as per IAS 32 Financial Instruments: Presentation.

The most applicable accounting standard would appear to be IAS 38 Intangible Assets because cryptocurrency is an identifiable non-monetary asset without physical substance.

Although cryptocurrencies most likely fall within the scope of IAS 38, the measurement models in that standard do not seem appropriate. The fair value of cryptocurrency is volatile so a cost based measure is unlikely to provide relevant information. The revaluation model in IAS 38 initially seems more appropriate, but this requires gains on premeasurement to fair value to be presented in other comprehensive income. Many entities invest in cryptocurrencies to benefit from short-term changes in fair value and gains or losses on short-term investments are normally recorded in profit or loss (e.g. assets inside the scope of IFRS 9 Financial Instruments).

As can be seen, the accounting treatment of cryptocurrencies is not straight- forward. In the absence of an appropriate accounting standard, preparers of financial statements should refer to the principles in existing IFRS Standards as well as the Conceptual Framework in order to develop an accounting policy.

Initial coin offerings

Initial coin offerings (ICO) are a method of raising finance through cryptographic assets. Investors (sometimes called supporters) buy into the ICO and receive tokens in exchange. This is similar to the approach used in crowdfunding, with ICOs originally being used tech entrepreneurs.

The tokens received might entitle the holder to cryptocurrencies, or they might be utility tokens (which provide users with access to a product or service) or security tokens (which might provide an economic stake in an entity, or the right to receive cash or assets in the future). Tokens can become valuable and can often be traded on a crypto exchange.

ICOs are largely unregulated, allowing companies to bypass the regulated and lengthy process of raising finance through a bank.

When an entity raises funds in this way, it will record the receipt of an asset as the debit entry (this might be cash or a different cryptocurrency, such as Bitcoins). However, the key consideration is determining the credit entry that should be posted. This is dependent on the nature of the tokens issued.

Possibilities include:

- Financial liability – the reporting entity might be contractually obligated to deliver cash or another financial asset to the holder of the tokens.

- Equity – the holder of the token issued through the ICO may be entitled to payments out of distributable reserves. This would qualify as equity if the reporting entity was under no contractual obligation to deliver cash or another financial asset.

- Revenue – this might apply if the recipient was a customer and if a ‘contract’ (per IFRS 15 Revenue from Contracts with Customers) exists.

- None of the above – if there is a legal or constructive obligation to the subscriber then a provision should be recognized in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets. If an entity determines that no specific

IFRS Standard applies to its issued tokens, then it should refer to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors in order to develop an appropriate accounting policy. This will require reference to the Conceptual Framework.

Natural disasters

Natural disasters include volcanic eruptions, earthquakes, droughts, tsunamis, floods, hurricanes and pandemics. Natural disasters devastate communities, and the process of recovery can take years. Companies that operate in areas effected natural disasters will also have to consider the financial reporting consequences. Some of these are considered below:

Impairments

A natural disaster is likely to trigger an impairment review – particularly in relation to property, plant and equipment (PPE). This is because, in accordance with IAS 36 Impairment of Assets, there are likely to be indicators of impairment. This may be because individual assets are damaged, or it may be because the economic consequences of

the disaster trigger a decline in customer demand. If PPE is destroyed, then it should be derecognized rather than impaired.

In line with IFRS 9 Financial Instruments, entities that lend money will need to assess whether credit risk associated with the financial asset has increased significantly. A natural disaster is likely to lead to a higher default rate, so some financial assets will become credit-impaired.

Natural disasters may lead to inventory damage. Alternatively, the economic consequences of the disaster may mean that inventory must be sold at a reduced price. As per IAS 2 Inventories, some inventory may need to be remeasured from its cost to its net realizable value.

Insurance

It is likely that entities affected natural disasters will need to account for insurance claims. This can be a difficult area because of uncertainty regarding the nature of the claim, the type of coverage provided the insurance, and the timing and amount of any proceeds recoverable.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets only allows the recognition of an asset from an insurance claim if receipt is virtually certain. This is a high threshold of probability and so recognition is unlikely. However, if an insurance pay-out is deemed probable then a contingent asset can be disclosed.

Additional liabilities

As a result of a natural disaster, an entity may decide sell or terminate a line of business, or to save costs reducing employee headcount. In accordance with IAS 37, a provision will be recognised if there is a present obligation from a past event and an outflow of economic benefits is probable. An obligation only exists if a restructuring plan has been implemented or if a detailed plan has been publicly announced. When measuring the provision, only the direct costs from the restructuring, such as employee redundancies, should be included.

Provisions may be required if there is an obligation to repair environmental damage. Moreover, decommissioning provisions (when an entity is obliged to decommission an asset at the end of its life and restore the land) will require review because the natural disaster may alter the timing or amount of the required cash flows.

Going concern

Natural disasters will lead to changes in the economic environment, as well as business interruption and additional costs. It may be that bank loan covenants are breached. If there are material uncertainties relating to going concern, then these must be disclosed in accordance with IAS 1 Presentation of Financial Statements. If the going concern assumption is not appropriate then the financial statements must be prepared on an alternative basis and this fact must be disclosed.

Constant purchasing power (CPP) Key features

• Financial statements are adjusted to show all figures in terms of money with the same purchasing power.

• A general price index is used for this, applying a general level of inflation.

• Figures in the statement of profit or loss and statement of financial position are adjusted the CPP factor.

• CPP factor = (Index at the reporting date/Index at date of initial recognition)

In converting the figures in the basic historical cost financial statements into those in the CPP statement, a distinction is drawn between:

• monetary items

• non-monetary items.

Monetary items are those whose amounts are fixed contract or otherwise in terms of numbers of units of currency, regardless of changes in general price levels. Examples of monetary items are cash, receivables, payables and loan capital.

Holders of monetary assets lose general purchasing power during a period of inflation to the extent that any income from the assets does not adequately compensate for the loss in purchasing power. The converse applies to those having monetary liabilities.

Non-monetary items include such assets as inventory and non-current assets. Retaining the historical cost concept requires that holders of non- monetary assets are assumed neither to gain nor to lose purchasing power reason only of changes in the purchasing power of the unit of currency.

The owners of a company’s equity capital have the residual claim on its net monetary and nonmonetary assets. The equity interest is therefore neither a monetary nor a non-monetary item.

Advantages and disadvantages of CPP accounts

Advantages

• CPP accounting is both simple and objective. It relies on a standard index.

• It adjusts for changes in the unit of measurement and therefore is a true system of inflation accounting.

• It measures the impact on the entity in terms of shareholders’ purchasing power.

Disadvantages

• It fails to capture economic substance when specific and general price movements diverge

• The unfamiliarity of information stated in terms of current purchasing power units.

• CPP does not show the current values to the business of assets and liabilities

• The general price index used is not necessarily appropriate for all assets in all businesses

• The physical capital of the business is not maintained.

Elements of the financial statements Assets ‘An asset is

• a present economic resource controlled the entity

• as a result of past events’

‘An economic resource is a right that has the potential to produce economic benefit.’

Liabilities ‘A liability is

• a present obligation of the entity

• to transfer an economic resource as a result of past events’

Equity interest

‘Equity is the residual interest in the assets of the entity after deducting all its liabilities’

Income ‘Income is

• increases in assets or decreases in liabilities, that result in increases in equity, other than those relating to contributions from holders of equity claims’

Expenses ‘Expenses are

• decreases in assets or increases in liabilities, that result in decreases in equity, other than those relating to distributions to holders of equity claims.’