CPA ADVANCED LEVEL

PILOT PAPER

ADVANCED TAXATION

December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

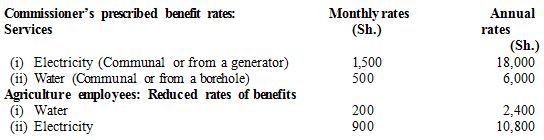

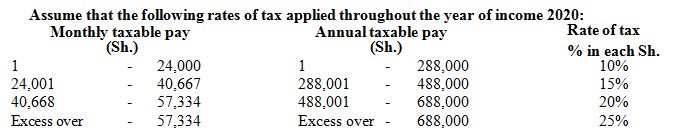

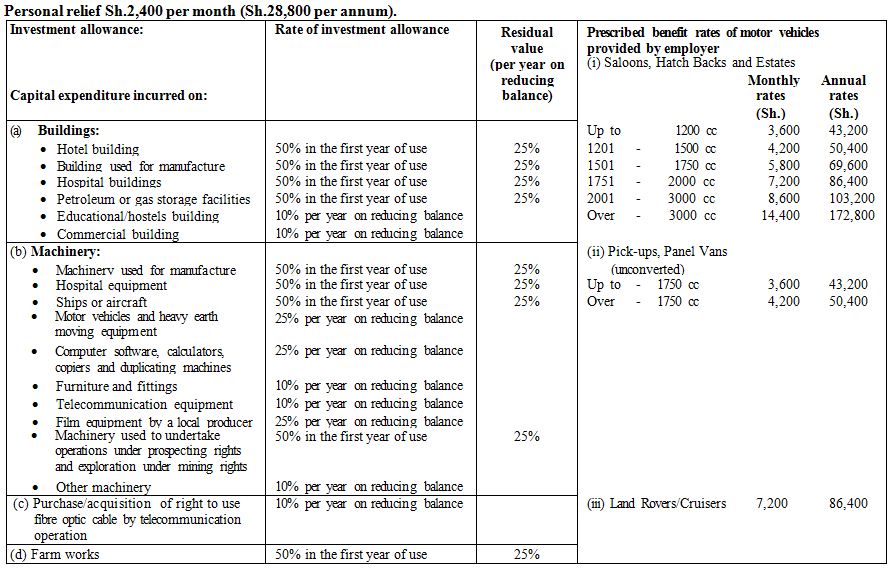

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

QUESTION ONE

(a) Explain the meaning of “alternative dispute resolution”. (2 marks)

(b) All tax disputes can be resolved through alternative dispute resolution (ADR) with some exceptions.

With reference to the above statement, describe the exceptions. (6 marks)

(c) Omari Hassan has approached you as the tax expert, to advise him on which of the following two job offers to accept. Hassan has received two offers of employment both of which require him to report for duty next year on 1 January 2022.

He has provided you with the following information Job offer A: Maua Growers Ltd.

Terms of employment:

1. A basic salary of Sh.1,680,000 per annum.

2. Free housing for him and his family within the farm, with free water and electricity. The water is from a borehole sunk in the farm. The electricity is also generated within the farm.

3. Free supply of the farm produce subject to a maximum value of Sh.50,000 per month.

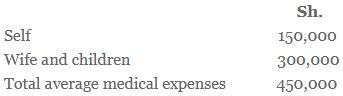

4. Reimbursement of medical expenses incurred on self and family subject to a maximum of Sh.125,000 per month. The reimbursement policy only applies to the senior managers.

5. Payment of his children’s school fees amounting to Sh.180,000 per annum the employer. The employer will not expense it in his books of account.

6. His annual subscription fee to the sports club amounting to Sh.50,000 would be paid for the employer.

7. He would be required to register as a member of the Institute of Certified Public Accountants. The employer would pay the annual subscription fee of Sh.18,000.

Job offer B: Kilwa Dishes Ltd.

Terms of employment:

1. A basic salary of Sh.2,160,000 per annum.

2. Free housing and meals but only for self.

3. Monthly entertainment allowance of Sh.15,000.

4. Payment the employer of his medical expenses subject to a maximum of Sh.800,000 per annum. The medical scheme covers all hotel employees.

5. Payment the employer of his life assurance premiums amounting to Sh.5,000 per month.

6. Reimbursement the employer of his annual subscriptions for the Journal of Certified Public Accountants amounting to Sh.2,500 per annum.

7. A one week fully paid holiday package worth Sh.150,000 for his wife and children to visit him and reside at the hotel once per year. The package would also include visits the family to neighbouring tourist attractions.

Omari Hassan has further provided the following additional information:

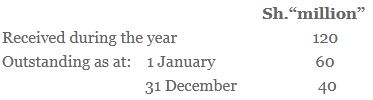

. His annual average medical expenses are as follows:

. His consumption of the farm produce under job offer A would average about Sh.300,000 per annum.

Hint: Your evaluation should include both taxable and non-taxable benefits. Use year 2020 tax rates.

Required:

Evaluate the two job offers and advise Omari Hassan on which offer to accept based on expected net annual income.

(12 marks)

(Total: 20 marks)

QUESTION TWO

(a) Under Section 24 of the Income Tax Act, a company is required to adhere to the rules under the shortfall distribution.

If a company is unable to pay the required amount, it has to make a representation to the tax department.

In relation to the above provision, explain four factors that must be included in its representation. (4 marks)

(b) Explain the meaning of thin capitalisation in relation to an entity. (3 marks)

(c) The management of Bituls Ltd. has received a notice from the Commissioner for Domestic Taxes stating that the

company is subject to the income tax rules on thin capitalization. The management intends to object to the Commissioner’s directive and have approached you for advice.

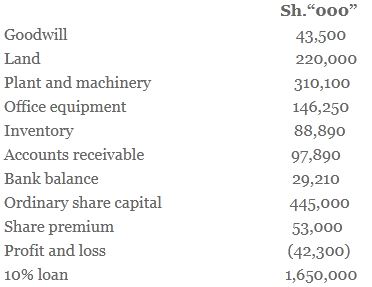

An extract of the company’s statement of financial performance revealed the following:

Supporting your answer with suitable computations, advise the management of Bituls Ltd.:

(i) On the possible outcome of its objection. (4 marks)

(ii) The interest tax shield due to Bituls Ltd. based on your advice in (c) (i) above. (2 marks)

(d) (i) Explain the taxable incomes of a life assurance company. (3 marks)

(ii) The following information relates to Beta Life Assurance Company Limited for the year ended

31 December 2020:

The fund balance was valued an actuary at Sh.220 million as at 31 December 2020. 40% of this fund balance was recommended to be transferred for the benefits of shareholders.

Management expenses and commissions paid during the year amounted to Sh.40 million and Sh.6 million respectively.

The company had no other income during the year.

Required:

Taxable income of Beta Life Assurance Company Limited for the year ended 31 December 2020. (4 marks)

(Total: 20 marks)

QUESTION THREE

(a) (i) Explain how a company operating in Kenya but with its headquarters in another country may avoid taxation through transfer pricing. (5 marks)

(ii) A few countries and regions in the world have established themselves as tax havens. Briefly summarise

three benefits that might accrue to an investor in a tax haven. (3 marks)

(b) Mary and Khadija are in a partnership trading as Mahadi enterprises: They share profits and losses in the ratio of 3:2

for Mary and Khadija respectively.

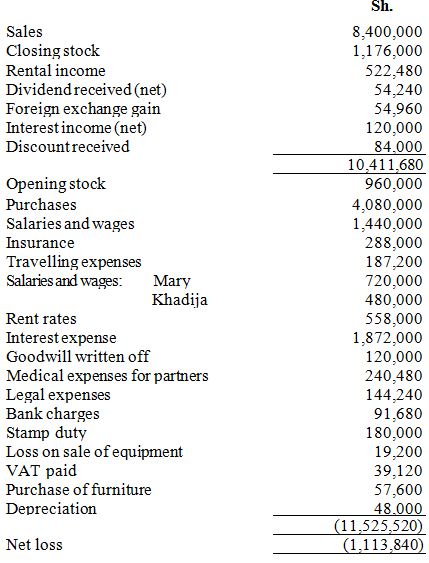

The partners presented the following statement of profit and loss of the partnership for the year ended 31 December

Additional information:

1. On 1 April 2020 Abwas admitted as a partner. She contributed Sh.960,000 as her share of capital and goodwill. The profit and loss sharing ratio was revised to 2:2:1 for Mary, Khadija and Abrespectively with effect from 1 April 2020. Abwas not entitled to a salary for the year ended 31 December 2020.

2. Interest expenses comprised:

Sh.

Interest on capital: Mary 432,000

Khadija 480,000

Abby 48,000

Interest on loan 672,000

Fridge benefit tax 240,000

1,872,000

3. All transactions relating to equipment and furniture occurred after 1 April 2020.

4. All other revenues and expenses accrued evenly throughout the year.

Required:

(i) Determine the adjusted profit or loss of the partnership for the year ended 31 December 2020. (8 marks)

(ii) Allocate the profit or loss computed in (b) (i) above to the partners. (4 marks)

(Total: 20 marks)

QUESTION FOUR

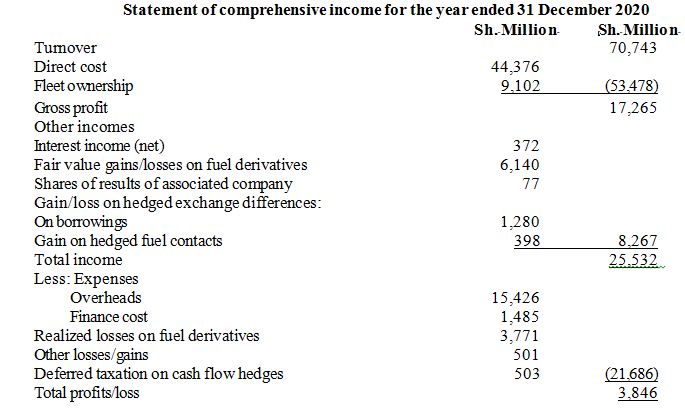

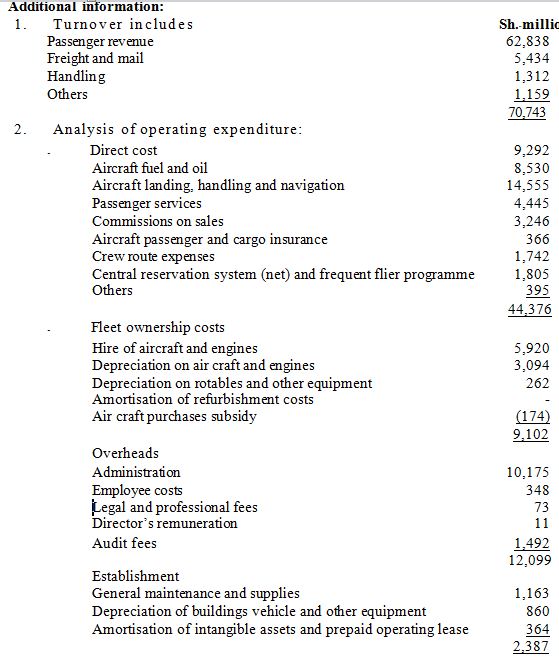

(a) BSI Fly High Ltd. presented the following trading results for the year ended 31 December 2020:

Required:

(i) Compute adjusted taxable income for the year ended 31 December 2020. (10 marks)

(ii) Tax payable, if any for the year. (2 marks)

(b) (i) In Kenya, tax agents are individuals or companies that prepare taxes on behalf of the tax payers, they also

offers professional assistance to people or companies that do not want to prepare taxes on their own.

In light of the above statement, explain circumstances under which a tax agent’s license may be canceled.

(4 marks)

(ii) Bandari Realtors’ Ltd. provided the following information relating to the sale of their properties in the year

2020.

1. Sale proceeds were Sh.2,000,000 and the incidental costs were; Legal fees – Sh.100,000;

Advertisement – Sh.50,000; Agent’s commission – Sh.200,000 and Valuation fees – Sh.150,000.

2. Cost of acquisition/construction was Sh.1,500,000 and the other relevant/ incidental costs were as

follows: Legal cost on acquisition – Sh.60,000; Valuation – Sh.70,000; Costs to change the roof of property – Sh.130,000; Legal cost to defend title Sh.50,000; investment allowance had been allowed totaling Sh.450,000 over the years.

Required:

Compute the capital gains tax. (4 marks)

(Total: 20 marks)

QUESTION FIVE

(a) Explain the challenges in implementing special economic zones (SEZs). (8 marks)

(b) Customs audit is the process of verifying that the business is in compliance with the customs legislation through the

examination of books and records of a business to prevent commercial fraud.

In relation to the above statement, explain the objectives of a customs audit. (4 marks)

(c) In case of back duty the tax department will reject the accounts presented to them and will advise the taxpayer to

provide another set of accounts prepared a reputable firm of auditors. Where presentation of accounts is not possible, the taxpayer’s income could be computed through capital statements.

Required:

Explain other circumstances under which capital statements are applicable in computation of income. (4 marks)

(d) Outline the documents which must accompany a claim for VAT refund under Section 24 (Bad Debts). (4 marks)

(Total: 20 marks)